Readiness 2030: What It Means for Europe’s Auto Industry

See how Readiness 2030 will reshape Europe’s auto industry through defense innovation, electrification, and strategic alignment.

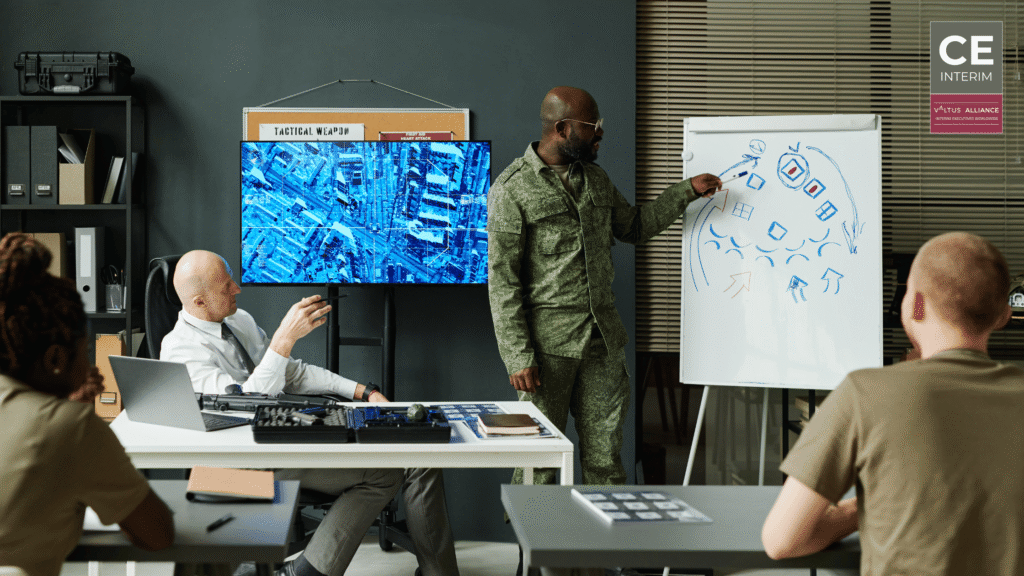

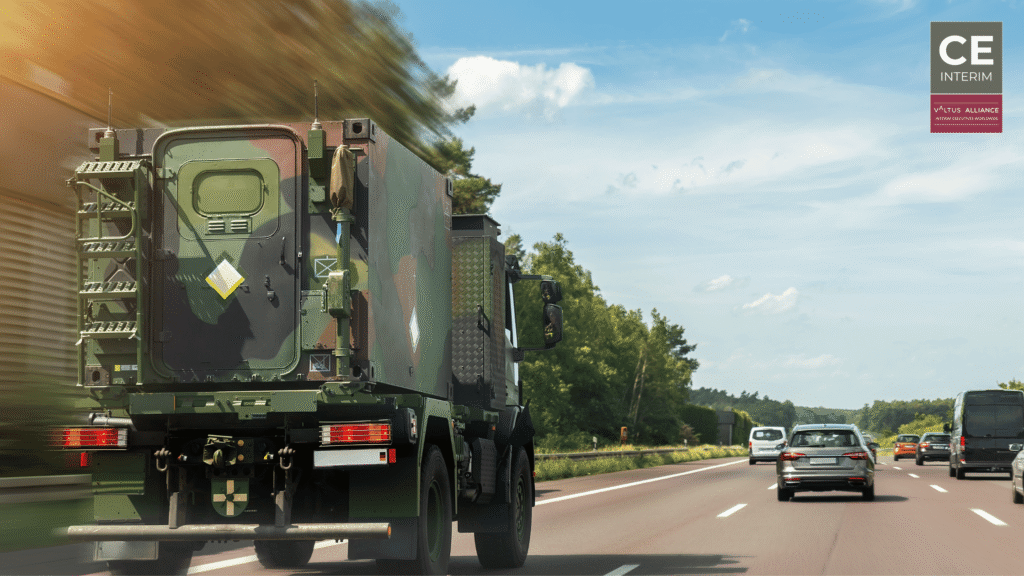

Relocating Auto Plants for Defense Contracts in Europe

Gain strategic insights on relocating auto plants to win European defense contracts. Explore key locations, challenges, and practical steps involved.

Europe’s Auto Crisis: Pivoting Fast to Defense Work

Explore Europe’s auto crisis & strategic pivot into defense manufacturing-opportunities, real examples & expert guidance for decisive action.

The Future of Germany’s Auto Sector: EVs, China, and Chaos

Germany’s Auto Sector faces EV disruption, Chinese competition, job cuts, and trade turmoil. Can it reinvent itself before it’s too late?

$500B Stargate Initiative: Challenges for Europe’s Industry

Explore how the $500B Stargate Initiative reshapes global AI, its challenges for Europe’s industry, & strategies to stay competitive.

Responding to Trump’s Tariffs: Europe’s Game Plan

Learn how Europe is responding to Trump’s tariffs with innovative strategies, market diversification, and resilient trade policies.

Europe Under Trump’s Trade Policies: Key Impacts

Analyze the effects of Trump’s trade policies on European businesses, covering past, present, and future impacts with expert insights.

Europe’s Digital Future Post-Trump: Why It’s Essential

Understand Europe’s Digital Future post-Trump and why embracing innovation, AI, and tech advancement is essential for global competitiveness.

Why European Firms Are Moving Manufacturing to Mexico

European firms are moving manufacturing to Mexico for cost savings, trade advantages, and proximity to the U.S. Here’s why it matters.

Saudi Market Entry: Overcoming Challenges for European Firms

Unlock success in Saudi Arabia! Navigate challenges, seize opportunities, and master Saudi market entry with expert strategies for European firms.