Not enough time to read the full article? Listen to the summary in 2 minutes.

Saudi Arabia, the largest economy in the Middle East, is undergoing a transformative period driven by its Vision 2030 initiative. Investing in Saudi Arabia through this ambitious plan aims to diversify the economy away from oil dependence, fostering growth in various sectors such as tourism, entertainment, renewable energy, and technology.

For investors, Saudi Arabia presents a unique blend of opportunities and challenges, making expert guidance crucial for success. Interim management services, like those provided by CE Interim, offer the expertise needed to navigate this rapidly changing landscape.

Economic Overview

Saudi Arabia’s economy relies on oil, yet recent reforms spurred significant growth in non-oil sectors, diversifying its financial landscape. As of 2023, the country’s GDP is estimated to be around $905 billion, with a growth rate of 4.2% projected for 2024, according to the International Monetary Fund (IMF).

Saudi Arabia Economic Indicators

| Indicator | Value |

|---|---|

| GDP | $905 billion |

| Projected GDP Growth (2024) | 4.2% |

| Inflation Rate | 2.5% |

| Unemployment Rate | 6.8% |

Vision 2030 and Economic Diversification

Vision 2030 is pivotal for Saudi Arabia, shifting focus from oil to sectors like tourism, healthcare, and renewable energy. The Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund, plays a pivotal role in financing and driving these initiatives.

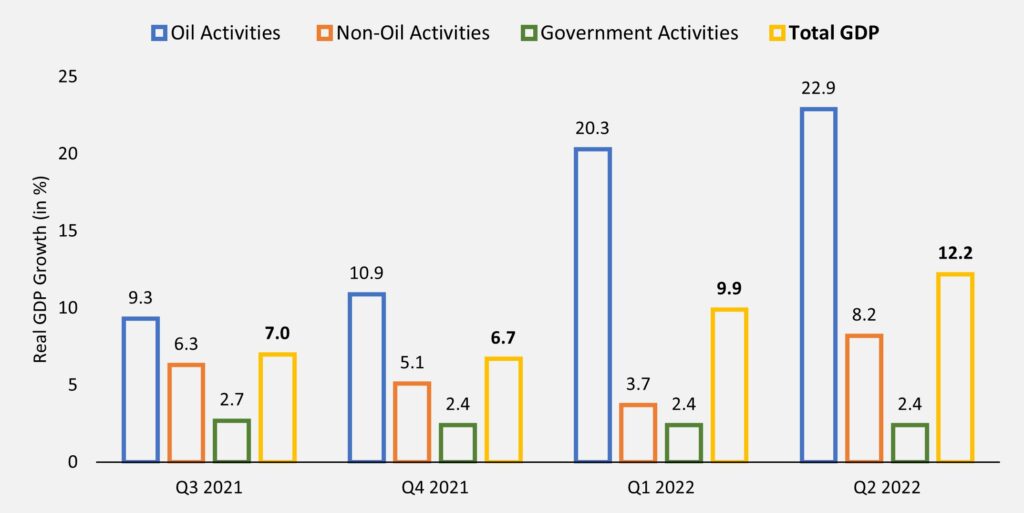

Sectoral Contribution to Saudi GDP

A bar chart show the shift in GDP contribution from oil to non-oil sectors, highlighting the success of Vision 2030 initiatives.

This economic shift has made Saudi Arabia an attractive destination for foreign direct investment (FDI). In 2023, FDI inflows reached $11.4 billion, reflecting growing investor confidence in the country’s long-term prospects.

However, entering the Saudi market requires a deep understanding of local regulations, culture, and business practices.

CE Interim offers interim management services to help businesses navigate complexities, ensuring compliance and alignment with Vision 2030 objectives.

Key Investment Sectors

Saudi Arabia’s diversification strategy has opened up several key sectors to foreign investors.

Here are the top sectors offering promising opportunities:

1) Tourism and Entertainment: The Kingdom is investing heavily in tourism infrastructure, with projects like NEOM, Red Sea Project, and Qiddiya, aimed at making Saudi Arabia a global tourism destination. The government aims to increase the contribution of tourism to GDP from 3% to 10% by 2030.

2) Renewable Energy: Saudi Arabia plans to generate 50% of its electricity from renewable sources by 2030. The country prioritizes solar and wind energy, investing heavily in projects like Sakaka PV IPP, the Kingdom’s first large-scale renewable energy initiative.

3) Healthcare: The healthcare sector is expanding rapidly, driven by population growth and government initiatives to improve healthcare services. The government is opening up the sector to private investment, offering opportunities in hospital management, medical equipment, and pharmaceutical production.

4) Technology and Innovation: Saudi Arabia invests in tech and innovation through the Saudi Data and AI Authority (SDAIA) and tech hub development. The focus is on smart cities, AI, and blockchain, offering lucrative opportunities for tech companies.

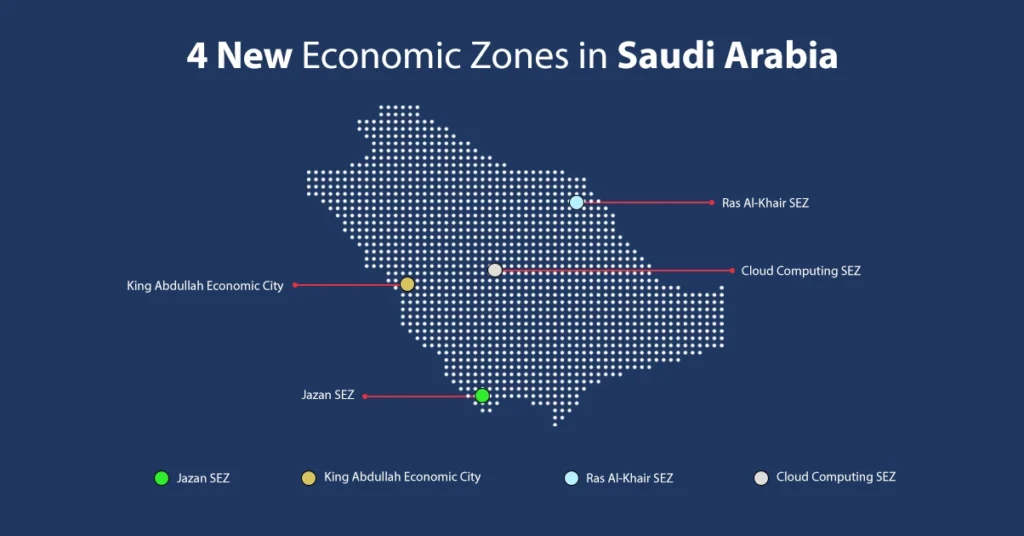

Major Economic Zones and Investment Projects in Saudi Arabia

A map highlight key economic zones and mega projects across the country.

For businesses looking to invest in these sectors, understanding the local market dynamics is crucial. CE Interim’s interim managers bring sector-specific knowledge and experience, helping businesses develop strategies that align with Saudi Arabia’s economic goals and ensure long-term success.

Strategic Location and Infrastructure

Saudi Arabia’s strategic location, connecting Asia, Africa, and Europe, positions it as a crucial hub for global trade. The country has invested heavily in infrastructure to enhance its position as a global logistics center.

Saudi Arabia Infrastructure Rankings

| Infrastructure Type | Global Ranking | Details |

| Quality of Roads | 4th among G20 nations | Ranked 4th globally in 2023 with a road quality score of 5.7. |

| Air Connectivity | 13th globally | Improved from 27th in 2019 to 13th in 2023 on the IATA index. |

| Port Infrastructure | 16th globally | Moved up from 24th to 16th in 2023 in annual container throughput. |

Saudi Arabia’s infrastructure development is driven by Vision 2030, with significant investments in expanding and modernizing transport networks, ports, and airports.

King Abdulaziz Int’l Airport & King Abdullah Port boost the Kingdom’s connectivity & trade capabilities, showcasing strategic initiatives for growth.

For investors, leveraging Saudi Arabia’s strategic location is key to accessing regional and international markets.

CE Interim offers interim management solutions that help businesses optimize their logistics and supply chain operations, ensuring efficient market entry and expansion.

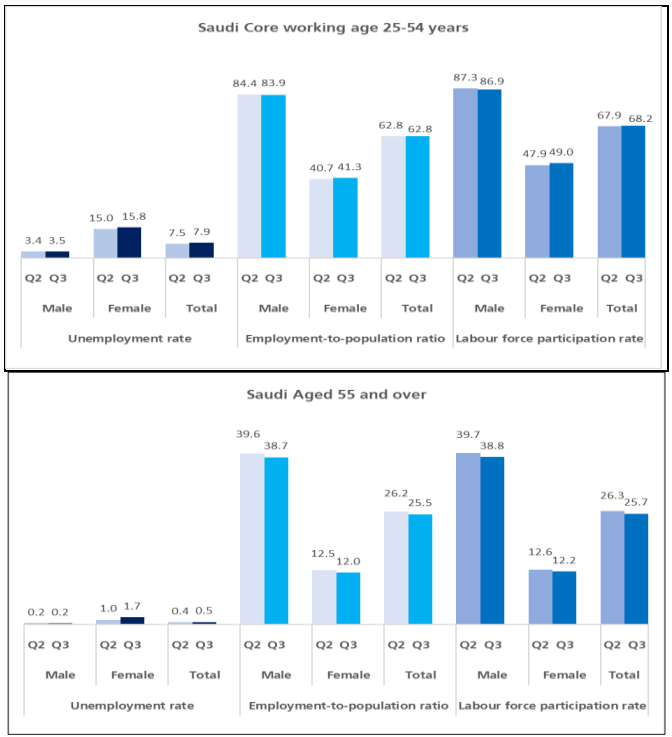

Workforce and Education

Saudi Arabia is focused on developing a highly skilled and diversified workforce as part of Vision 2030. The government is investing in education and training programs to equip Saudis with the skills needed for a knowledge-based economy.

The Saudization policy, which requires companies to hire a certain percentage of Saudi nationals, is a critical aspect of the labor market. While this policy supports local employment, it can pose challenges for foreign companies unfamiliar with local labor laws and regulations.

Workforce Composition in Saudi Arabia (2023)

CE Interim provides expert interim managers who can help companies navigate Saudization requirements, ensuring compliance while effectively managing a diverse workforce.

Legal and Regulatory Environment

Saudi Arabia has made significant strides in improving its business environment, ranking 62nd in the World Bank’s Ease of Doing Business index in 2020, up from 92nd in 2016. Reforms have focused on simplifying business registration, enhancing legal protections for investors, and streamlining regulatory procedures.

However, the legal landscape in Saudi Arabia can still be challenging for foreign companies. Navigating the complexities of Saudi business laws, especially in terms of partnerships, contract enforcement, and regulatory compliance, requires expert guidance.

CE Interim’s managers bring vast Saudi regulatory and business expertise, guiding companies to succeed in this market effectively.

Conclusion: Unlocking Opportunities in Saudi Arabia

Saudi Arabia’s ambitious Vision 2030 plan has created a wealth of opportunities for investors across a range of sectors. Investing in Saudi Arabia is particularly attractive due to the country’s strategic location, robust infrastructure, and commitment to economic diversification, making it a prime destination for businesses looking to expand in the Middle East.

However, the unique challenges of the Saudi market—ranging from regulatory compliance to cultural nuances—require specialized expertise. CE Interim offers tailored interim management solutions that help businesses overcome these challenges, ensuring smooth market entry and long-term success.

By partnering with CE Interim, companies can leverage the full potential of investing in Saudi Arabia’s dynamic economy, achieving their strategic goals and contributing to the Kingdom’s vision of a diversified, sustainable future.